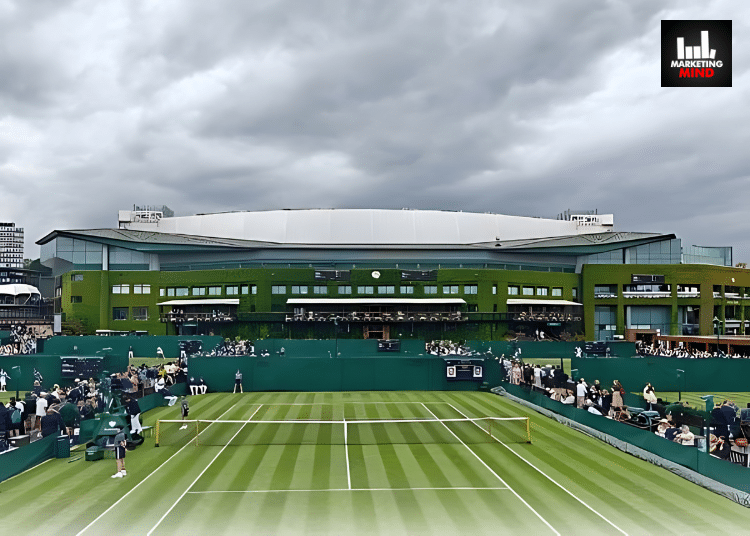

Often evoked in the realm of Wimbledon is the phrase, ‘Where Champions Become Legends’, encapsulating the essence of The Championships, Wimbledon—the epitome of tennis grandeur. Held annually amidst the cultural tapestry of London, this event seamlessly marries tradition with riveting athleticism.

With its pristine grass courts and iconic moments, Wimbledon – which began on July 1 and concluded on July 14 – not only serves as a premier tennis spectacle but also cultivates an unparalleled ambiance, drawing in viewers and brands alike. It stands as a coveted platform where brands converge to engage with a discerning audience, seeking aspiration and excellence.

Industry players highlighted that brands in India are increasingly realising the significant opportunities in aligning with Wimbledon, capitalising on its exclusive and prestigious image to distinguish themselves in a competitive market. Sponsoring Wimbledon provides a distinctive opportunity for brands to connect with a dedicated and affluent fan base.

Wimbledon was broadcasted on Select 1, Select 2, SS2 and SS1 Hindi for the finals, on the Star Sports Network.

Earlier, Disney Star announced a lineup of sponsors for the world’s oldest and prestigious tennis tournament. This year, eleven sponsors, including brands like Hyundai, House of Glenfiddich, Jaquar, Castrol, Kohler, Zepto, Amul, Xiaomi, LIC, Natural Diamond Council and Disney Adventure Cruise Line joined to support the event.

Why Wimbledon matters to Indian brands

R Venkatasubramanian, Chief Operating Officer, Havas Play, said that Wimbledon is a prestigious event in the tennis calendar each year and brands from all around the world look at featured integration and/or digital collaborations.

“Tennis being a strategic choice for luxury brands has given the Grand Slams a unique opportunity to connect and target the HNI fanbase in all relevant markets. From India, brands like Hyundai, House of Glenfiddich, Hair Appliances, Jaquar, Castrol, Kohler, Natural Diamond Council and Disney Adventure Cruise Line have associated with the third Grand Slam of the year tapping into the June-July timeline for brands to enhance their visibility and pass on a strategic message about their premium products and services,” he added.

Similarly, Varun Mohan, Head of Revenue and Growth at MiQ Digital, underscored that as the premiumisation trend grows in urban India, many brands are looking to target and capture the mindshare of affluent audiences with events like Wimbledon and its rich history.

“Advertising during Wimbledon offers brands an opportunity to maintain visibility beyond the IPL season in the run up to the festive season and reach a diverse set of audiences. Advertising during sports events like Wimbledon, Euro and Olympics on Connected TV and digital also offer brands incremental reach beyond linear TV households to cord-cutters, cord-shavers and cord-nevers,” Mohan said.

“Wimbledon’s premium appeal makes it an ideal platform for brands to elevate their presence and connect authentically with audiences who value sophistication, quality, and tradition. Especially for lifestyle and luxury brands in sectors such as high-end fashion, luxury retail, automobile, consumer technology and travel,” he added.

He also pointed out that in recent times, many Indian athletes have excelled in other sports such as Olympics, Hockey, Badminton, Asian Games, Chess, and others. There is a growing interest among spectators in non-cricket sports including football, tennis and hockey.

Furthermore, he went on to say that major events such as Wimbledon are steadily gaining popularity, especially among urban and affluent demographics. It proved popular in 2023 and was watched by 25.5 million television viewers and a new record of 53.8 million online streams, underlining the diversification of the tournament’s audience as well as the efficient use of online media to interact with people.

“For brands, partnering with such affluent events are directly connected to their international expansion plans for that specific location. Engaging with the audience in those areas will help them to build a strong presence and appeal for the brand,” Mohan added.

Shantanu Ghosh, National Director – Sports, Wavemaker India, said that tennis as a sport enjoys a niche audience in India.

“Among all the Grand Slams, ATP/WTA 1000, Tennis in the Olympics, or ATP/WTA Finals, Wimbledon enjoys a slight premium stature as compared to others. There are several factors why Wimbledon might be considered the most prestigious tennis event: it’s a grass court event (there are not many grass court events in the tour currently), it hosts world-renowned celebrities, and we often see Indian cricketers enjoying a match at SW19. Hence, it has a high-class appeal. As for categories, I believe industries such as automobiles, premium watches/jewellery, tech companies, premium apparel, surrogate alcoholic beverages, bath accessories, and e-commerce find Wimbledon the right sport to connect with their target audience,” he added.

On the other hand, Sri Harsha, Associate Vice President and Cluster Head, Mudramax stated that Wimbledon is considered as one of the oldest and the most coveted premium sporting events in the world. However, given the nature of the sport, it offers very limited advertising windows for the advertisers unlike other popular sports like cricket given the number of breaks are higher there to create a dent in consumer’s mind.

“Legacy Indian Brands targeting affluent consumers do understand the cost per contact is higher to reach out to this set of audience compared to larger set of regular audience. Categories such as Auto, Airlines, Luxury sanitary fittings and Watches find strong relevance in this space,” he said.

“Harsha pointed out that given the relatively low advertising opportunities on the event, most of the advertisers rely on ‘on-ground’ and ‘on the content’ presence to create top of mind recall among the consumers. Given it’s a global event, only global brands tend to occupy on-ground space. The sport has a loyal audience and hence the number of brands on the event is increasing year on year,” he added.

Striking a similar tone, BK Rao, Senior Category Head – Marketing, Parle Products, mentioned that Wimbledon is synonymous with premium appeal, attracting high-end brands eager to associate with this prestigious event.

“Unlike cricket or soccer, which boast widespread mass appeal, Wimbledon captures the interest of a more niche audience. This unique demographic draws advertisers and brands looking to connect with an exclusive, discerning viewer base,” he added.

Meanwhile, Anurag Tandon, Chief Growth Officer, Cheil X, emphasised that the changing landscape in our country has presented an opportunity for a lot of niches to meaningfully co – exist along with mainstream waves. For the longest, cricket has been the go to mainstream sport property for marketers to leverage for objectives like awareness creation, impact and reach. Football has been a distant second.

“This has been a successful formula for a set up which was very traditional media forward. The new reality is different. Content consumption on the go and connected TV are two such new realities. Juxtapose this with another new reality. A plethora of new brands disrupting the traditional ecosystem of established categories,” Tandon added.

From Atomberg to Moxie and The Whole Truth, the spectrum is vast. Each shares a common thread: premium pricing for products that innovate, disrupt traditional norms, or fulfil distinct, niche demands. These are not your typical one-size-fits-all offerings, he said.

He highlighted that most of these brands rely on performance amongst other things as a key tool to build a consideration pipeline. This is where content like Tennis and especially Wimbledon can be leveraged meaningfully to build awareness versus bidding on keywords in over crowded categories to reach a more premium/discerning audience profile.

This approach can be further sharpened by doubling down and mapping audience profiles to the nature of products.

“To illustrate the point – fitness and nutrition is a key consumer trend in metros. Any brand in this space can make a meaningful impact by using tennis and working on media innovations with game moments like aces, rallies, break points to name a few,” Tandon said.

He elaborated that consider a brand like GoAthlos. The product range is more training, running and cycling focussed but messaging can be done in the context of tennis to build a broad fitness or preparation context.

Furthermore, Tandon suggested that while fitness might appear to be an obvious connection, this approach can also be applied to a brand like Atomberg. For instance, fans can serve as a clever means to engage with sports enthusiasts. Similarly, the brand’s range of mixers can be utilised creatively. Notably, Wimbledon has a tradition of serving Pimm’s Cup, a gin-based cocktail. Although the mixer itself won’t be used to make the cocktail, a smart message around ‘mixing with a certain type of people’ or ‘mixed doubles’ can effectively resonate with the audience.

“To sum it up, there are several opportunities to use this prestigious platform for brands that have the ambition and the vision to interpret the existing order a bit differently,” he added.

Earlier, the All England Lawn Tennis Club (AELTC) underscored year-on-year viewing figures in India increased +96% in 2023 compared with 2022 and entries into this year’s Wimbledon Public Ballot from fans in India rose +74% compared to last year. Acknowledging the growing popularity, the All England Club has identified India as a key growth market among its ongoing commitment to bring the unique atmosphere and excitement of Wimbledon to a global audience.

“India is one of our key growth markets and we are committed to taking The Championships to fans across the nation. Home to several legendary players, interest in tennis has grown tremendously in the past few years demonstrated by viewership figures, ballot entries and the growth of our social media platforms in India. We believe this is just the beginning of our close engagement with Indian fans, and we know that by bringing the Wimbledon experience directly to Indian fans, we will foster and grow their interest in The Championships and tennis even further,” he added.

Non-cricket sports partnerships on the rise for Indian brands

“I would say that everyone has now started to notice and pay increased attention to all the sporting disciplines. But still a lot of work is yet to be done to excel and become a true sporting nation,” Venkatasubramanian said.

Furthermore he went on to say, “The major change that is driving this phenomenon is that India is no longer in the following position, we are leading from the front, thanks to the spectacular performances by Neeraj Chopra, Saikhom Mirabai Chanu, PV Sindhu, Sumit Antil, Yogesh Kathuniya, Avani Lekhara at the Tokyo 2020 Olympic and Paralympic Games. Sumit Nagal and Ankita Raina are now the flag-bearers for India for tennis. With the Paris 2024 Olympic and Paralympic Games aligned in the next 2-weeks, we are expecting 2024-2025 to be a fantastic year. We are expecting the brands and sports ecosystem in India to reach newer heights in terms of the branding, visibility, and advertising for enhanced viewers experience.”

Ghosh said that the automobile sector has become prevalent in Wimbledon recently, along with e-commerce. Marketers find this sport the right platform to specifically target decision-makers. Hyundai, for instance, advertised in Wimbledon this year for their premium offerings like the Verna or Tucson.

“Associating with a non-cricket sport offers brands multiple advantages. It’s cost-effective, and the demographic and psychographic target audience is extremely focused. While it may not offer the reach that cricket does, marketers evaluate this based on the investment and frequency of messaging to a smaller, more engaged base. Qualitatively, association with premium sports like tennis also helps in enhancing the brand’s attributes such as premiumness, trust, and quality,” he added.

Harsha emphasised that tennis in India is still considered a niche sport and has a very limited access to a lot of Indian audience to experience the sport due to lack of infrastructure.

“What’s interesting to notice is the viewing behaviour on niche sports is increasing year on year due to Indian athletes bringing accolades. The quality of the audience on digital platforms for this sport is much higher than TV,” he added.

On the other hand, Tandon mentioned that while, up to this point, he hasn’t observed any noticeably different brand integrations or associations at Wimbledon, the usual premium watch and smartphone brands continue to dominate the media coverage during the match broadcasts.

“That said, there is an opportunity for a brand like Welspun that owns Christy, the brand that manufactures Wimbledon towels to do what ‘On’ as a brand did with Zendeya and Federer,” he added.

According to Mohan, in the fast-paced world of brand promotion, sports marketing has emerged as a powerful tool for creating lasting associations and engaging audiences.

He added, “Wimbledon is one of the most coveted tennis tournaments in the world and brands like Hyundai, Amul, Zepto, Castrol, Xiaomi, Disney and a few others used this prestigious event. The Indian fashion and lifestyle brand Allen Solly partnered with Wimbledon to launch their special men’s apparel.”

Long-term growth strategies for Indian brands leveraging global sporting events

Harsha said, “All the Indian brands should take note that global sporting events like Wimbledon have an affluent loyal audience base. Hence, to see the real strong impact of this event, consistency is the key. Over a period of time, consumers should associate your brand with the event name.”

He also mentioned that one time association on these events might not yield the kind of impact the event is capable of delivering. For example, Rolex and Wimbledon go hand in hand over a period of time to deliver excellent recall. In Indian context, Kent’s association with cricket through ‘Kent Cricket Live’ (Pre match show) delivers that kind of recall among the consumers. So, marketers who are trying to reach affluent audiences must have these global events on their marketing calendar to drive impact over a period of time.

Mohan highlighted that leveraging global sporting events has become an essential strategy for Indian brands, and it’s likely to continue growing in India.

“We foresee marketers and brands will continue leveraging global sporting events, and their marketing strategies will evolve to engage fans creatively and boost their international presence. Sports marketing is booming in India, all brands increasingly support local sports through sponsorships,” he said.

He added that by partnering with popular leagues like the IPL or Pro Kabaddi League, they promote their brands and become part of people’s passions. At the same time, it has been witnessed that Indian brands strive for global recognition, in the recent past all major brands have engaged with global sporting events through partnerships, and brands like Tata Motors, Amul, Hero MotoCorp, Infosys, and Mahindra Racing have already ventured into international events like wrestling, tennis, golf, and Formula E.

“Strategies include on-kit sponsorships, digital platforms, and in-arena visibility, enhancing brand engagement with fans. Participating in large-scale sporting events will help brands to double their investments,” Mohan said.

Venkatasubramanian highlighted that tennis is a premium sports property and ironically Wimbledon alone caters to 26 million television viewers, plus 54 million OTT/Streaming platform users as a significant audience base.

“In India, as of 2022 we had close to 100 million viewers for ATP, WTA and Grand Slam tournaments and the number is growing in a meaningful way,” he said.

“We strongly believe, sports in India have come a long way and we are on the verge of breaking records on multiple fronts be it Wimbledon, Olympics and Paralympic Games like we usually do with cricket properties around a financial year. It has been a great start for India in 2024 by hosting the FIH World Cup and Olympic Qualifiers and with high-impact properties lined up like the Ultimate Table Tennis (UTT), Pro Kabaddi League (PKL) and Indian Super League (ISL) lined up, we are confident that the impact of luxurious properties like Wimbledon will boost the business of sports in a more diversified and meaningful manner,” he added.

Venkatasubramanian said that Tennis, especially the Grand Slam such as Wimbledon are now more than just a sport.

“It is more of resonance with the greats of the world and brands always look for opportunities to leverage such high-impact properties to connect with the relevant audience bases and enable meaningful, reasonable, and resonating stories for people to really grasp the value of the products and services offered and enable agencies like ours to further bring in more and more value within the overall ecosystem of the Indian economy,” he emphasised.

“This year at Wimbledon, we saw some of the most influential people in the global economy in the Royal Box enjoying the game of Tennis. Brands like Hyundai Motors, House of Glenfiddich, Hair Appliances have been reviewing the insights and analysed the true potential to further establish a meaningful association with the luxurious world of sports in the global & Indian markets,” he added.

According to Mohan, Each brand has its own marketing budget and spends which influence its decision to sponsor or endorse a player or event. Tennis attracts an affluent, urban and globally minded audience, which can be a desirable demographic for some sponsors. The values and prestige of each athletic competition should be consistent with the brand’s core values.

“A brand’s intentions to expand internationally in a particular location are closely tied to their decision to associate with a particular event. With its appeal spanning across demographics that value sophistication and excellence, Wimbledon offers Indian brands a strategic avenue to showcase their offerings to discerning consumers on a global scale. They can develop a stronger presence and appeal for the brand by interacting with audiences in those regions,” he added.

Ghosh believes that there are multiple factors influencing the popularity of a sport in a country. Cricket, for instance, reached its peak after the 1983 World Cup triumph, while badminton gained popularity due to Indian players achieving great results in international tournaments.

“Tennis, being an individual sport, also requires players to perform and win on the global stage. Icons like Vijay Amritraj, Ramesh Ramakrishnan, Leander Paes, Mahesh Bhupati, and Sania Mirza have carried the torch for tennis in India, and now younger talents like Sumit Nagal are making their mark. When players achieve significant milestones, the sport gains popularity, making it viable for brands to invest in,” he said.

“India will witness substantial investments in emerging sports in the future. Government initiatives and investments in emerging sports will help build a larger talent pool and global performers. Our performances in global events like the Olympics give me confidence that India will become a dominant sporting nation in the future,” he added.

India’s evolving sports marketing landscape

Venkatasubramanian believes that India is no longer a sleeping giant or a follower in any form of economic development, and sports is a major part of this development. In 2023 alone, Indian athletes won 250+ medals in multiple sporting disciplines across Asian Games, South Asian Championships, World Championships.

Significant performance in Athletics, Boxing, Wrestling, Tennis, Hockey, Badminton, Weightlifting has made brands like Hyundai Motors, House of Glenfiddich, Hair Appliances, VISA, Eveready, Britannia, Kajaria Ceramics, PUMA to sit up and take notice and explore multiple collaborations. This has given the Indian markets a competitive advantage on all fronts, be it offline, online and digital properties and of course the on-ground sponsorships and activations.

“India has been preparing for a realistic approach towards the holistic development and enhancement of Sports. The year 2024 and 2025 will be a demonstration of a belief system banking on reliability, skill sets of the management professional and infrastructure that is being put in place to support various non-cricketing sports as well enabling brands to tap into those realistic markets for deeper sense and market connections,” Venkatasubramanian added.

Mohan stated that sports marketing presents a unique opportunity for brands to make an impact on sports fans in India, with events such as the T20 World Cup, English Premier League, Olympics, Wimbledon and Euros.

“We have seen IPL breaking viewership records for streaming on connected TVs and mobile devices, so it has become imperative for brands to incorporate CTV in their media mix and create innovative digital advertising strategies to increase reach and recall among their target audience. This shift has led to increased investment from brands across sectors, recognising sports as a powerful platform to engage with a passionate and diverse audience,” he said.

Furthermore, he went on to say, “Looking ahead, we predict continued growth in sports marketing, with brands leveraging data analytics and digital platforms for targeted campaigns that resonate deeply with fans. India is estimated to have over 30 million CTV households, which is projected to grow 4x in the next 3 years. Starting in 2024, marketers have been eagerly waiting for the properties that will make the most impact between elections and major sporting events leading up to the festive season.”

According to Harsha, the growth of non-cricketing sports has increased rapidly over a period of time. However, the viewing behaviour of non-cricketing sports has a lot of scope for improvement in the lower tier cities. Non-cricketing sports viewership is limited to metros at this point. Even in metros, the viewership of the global sporting events soars during the final stages of the event.

“With the growth of good sporting infrastructure across markets and Khelo India initiative, sports marketing is set to grow by 15-20% every year and advent of new non- cricketing sports superstars are set to change the way India consumes sports,” he added.

Rao expressed that the sports market in India is evolving significantly. For decades, we were a cricket-frenzied nation, but now there’s growing interest in a variety of sports. This includes soccer, tennis, table tennis, and other events. The horizon of sports in India is broadening, with diverse sports gaining popularity. Hockey, for example, is a sport that continues to attract many enthusiasts.

“Over time, the link between success and sports interest becomes evident. When Indian athletes achieve victories, it sparks a wave of enthusiasm among the youth. Suddenly, every child wants to be a hockey player, a soccer player, a tennis player, a shooter, or even a wrestler. Winning drives this surge in interest, inspiring the next generation to pursue these sports,” he added.