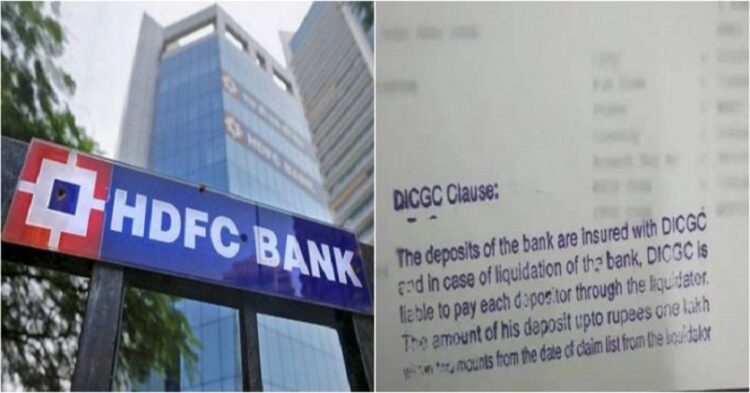

HDFC Bank recently became the cause of panic in the public when a passbook picture of the bank bearing a stamp of deposit insurance cover went viral on social media.

The stamp read,

“The deposits of the bank are insured with DICGC and in case of liquidation of the bank, DICGC is liable to pay each of the depositors through the liquidator. The amount of this deposit is up to Rs 1 lakh within 2 months from the date of claim list from the liquidator.”

Issuing a clarification, HDFC Bank said the information was not new and had been inserted as per a June 22, 2017 RBI circular.

“This pertains to information about the deposit insurance cover. We would like to clarify that the information has been inserted as per RBI circular dated June 22, 2017 which requires all Scheduled Commercial Banks, all Small Finance Banks and Payment Banks to incorporate information about ‘deposit insurance cover’ along with the limit of coverage upfront in the passbook,” the bank said in a statement.

“The passbooks without printed information have been stamped with the requisite information so as to be fully compliant with extant RBI guidelines,” the statement further added.

The recent incident of PMC Bank has led to a national debate on the low level of insurance coverage for deposits held by the public in banks. In an event of a bank going bust in India, depositors get a maximum of Rs 1 lakh per account as insurance cover, even if their deposits far exceed Rs 1 lakh.

While depositors holding less than Rs 1 lakh of deposits in a bank are covered by the deposit insurance, depositors holding more than Rs 1 lakh in an account have no legal remedy in case of the collapse of a bank.

Currently, the Deposit Insurance and Credit Guarantee Corporation (DICGC), a fully owned subsidiary of the Reserve Bank of India provides for cover of Rs 1 lakh per depositor for deposits in commercial banks, regional rural banks, local area banks (LABs) and cooperative banks, and rest of the deposit amount is forfeited in the rare event of a bank failure.