In its 47th meet in Chandigarh, the GST committee has now levied taxes on pre-packed items including food items. This means that rice and cereal that are bought unpacked will also have a GST charge levied on them. This was declared in the meeting held by finance minister Nirmala Sitharam with recommendations brought in by 4 GoMs as well.

When will this New Rule come into Effect?

The exemptions and correction of inversion will be put into effect from July 18th and have been considered by the GST Council of India. This was confirmed by Nirmala Sitharam.

Which Items will have GST Levied on them?

The following items are new on the list of goods with GST charged –

- Packaged Food and Pre-Packed items including curd, lassi and buttermilk.

- Hotel rooms charging Rs. 1000 per day will be put under the 12% GST slab.

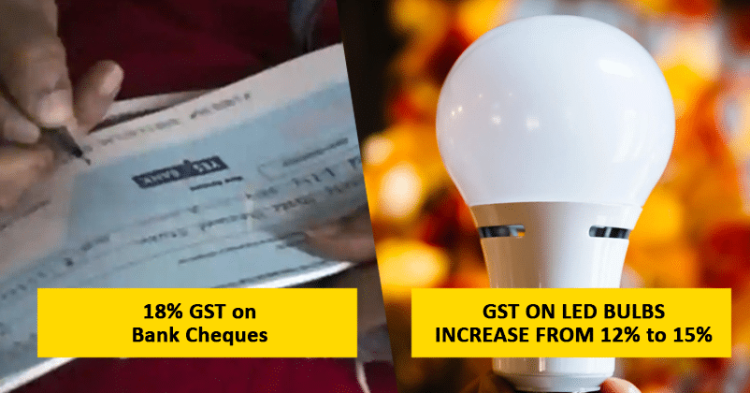

- Bank cheques issued will have an 18% GST applicable.

- Hospital room rents where patients pay more than Rs. 5000 per night will incur a 5% GST charge without ITC.

- LED bulbs and fixtures are supposed to incur a price hike with GST increasing from 12 to 18%.

- Turbines, centrifugal and bike pumps will also see an increase in GST charges from 12 to 18%.

Which Items will get Cheaper with the Revised GST Rates?

While some items and services gain a hike with the revised rates, some others see a tremendous slash in taxes.

- Renting of goods carriage will see a decrease in GST rates from 18 to 12%.

- The GST Council declared that passengers and goods travelling through ropeways will see a decrease in GST rates from 18 to 5%.

- Any orthopaedic appliances sold by companies will see a massive decrease in GST from 12 to 5%.

Source: News18