ZebPay has finally shut down due to government’s strict decisions towards cryptocurrency and this exit is a major set back for investors who were interested in putting their money into virtual currencies.

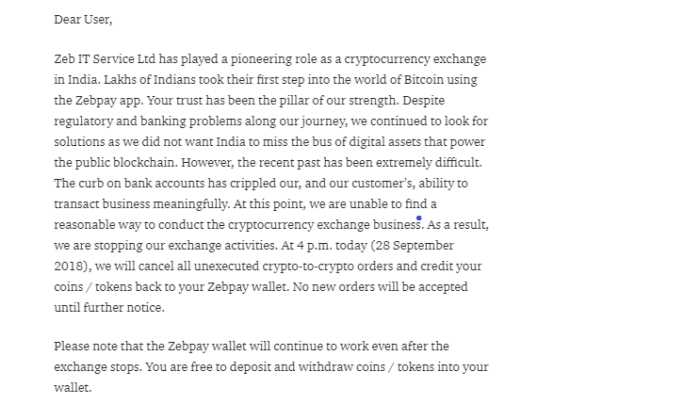

Operated by Ahmedabad-based Zeb IT Service Ltd, Zebpay announced its exit late last week with a blog post revealing the reason.

“The curb on bank accounts has crippled our, and our customer’s, ability to transact business meaningfully. At this point, we are unable to find a reasonable way to conduct the cryptocurrency exchange business,”

the post read. Let’s read what the exit of Zebpay means for the future of cryptocurrency based firms in the country.

For central banks around the world, cryptocurrency is a cause for concern as it doesn’t involve anyway to track the transactions and render the regulatory ways to control the money. This is considered as law enforcement in the form of anti-money laundering, taxation, and financial investigation.

India’s current laws are affecting all the crypto exchanges that operate from the country. Many have restructured operations and introduced new policies to cope up with the impact generated by the official Reserve Bank of India (RBI) notification.

Also Read: RBI Alerts Investors Against Virtual Currencies Like Bitcoin

The future of cryptocurrency in India

Cryptocurrency is still a very confusing term for Indian investors. A lot of people are avoiding it because of the increase in the online scams. There are very few companies who are working on educating Indians towards the blockchain technology and how they can benefit from it.

Also Read: Investors May Have Lost Rs. 500 Crore In Gujarat Bitcoin Scam

According to Anirudh Rastogi, founder of Ikigai Law, the results can go either way but the cryptocurrency ecosystem does not have much to lose.

“If the ruling were to uphold the ban then nothing changes, because that has been the case since the RBI circular came into effect from July and business will continue to operate as they currently do. On the other hand, if the court were to strike down the circular the business stands to benefit. But that again depends on the conditions under which the RBI circular is struck down.”

With the new regulations, peer-to-peer (P2P) cryptocurrency transaction platforms will become popular because they allow users to transact in cryptocurrency.

How does a P2P platform work?

When a user places a buy request in P2P, the exchange matches the buyer with another user who is looking to sell on the platform. The buyer then directly transfers money to the seller based on the shown information.

This way, the exchange doesn’t have to use its own bank accounts to deal in cryptocurrency. After the seller receives money in the account, the exchange gets notified and transfers the cryptocurrency from seller’s wallet to buyer’s wallet.

What are your thoughts on the future of cryptocurrencies in India? Do let us know your thoughts in the comments section.