If you are an income-earning individual or planning to start earning soon, you must be aware of the concept of purchasing power. In simple terms, it is the value of money that you or me possess. Now, the one main factor that influences our purchasing power is inflation. Inflation is a scenario where prices keep rising continuously over a period of time.

Now, why are we talking about all this? Well, because the past Indian RBI Governor Mr. Raghuram Rajan came up with this unique and valid concept of ‘Dosa economics.’ It is useful, appropriate, and extremely important for the masses to know.

What is the relation of Inflation to the concept?

Now, when we look at Inflation, we also look at our GDP growth. One proven fact is that both of those concepts share an inverse relation. This is exactly why when there is extremely high inflation, the central bank or RBI steps in to control it, to ensure the GDP doesn’t suffer. They try to cope with it by increasing the repo rate which further increases the fixed deposit rates.

The idea is that loan rates go up, people have lesser money to spare and the economy money circulation falls. However, people enjoy these high FD rates in high inflation, thinking that their money power has gone up. However, Mr. Rajan clearly proves and denies this.

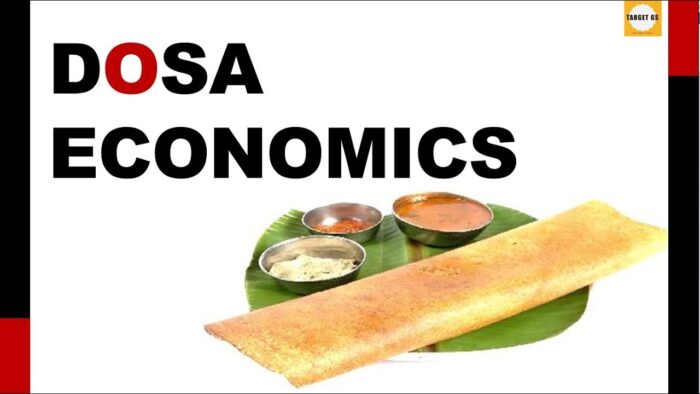

What is Dosa economics?

Dosa economics is a phenomenon where the former RBI governor uses Dosas to establish two key parameters. The first is the standard nominal interest rate, which is the current interest rate that a bank like SBI gives you. However, the fact is that people, especially our elders should NOT look at this nominal interest rate to see their gains.

What they need to look at is the ‘real interest rate’. This rate is what actually compares inflation, interest rate, and our principal investment. This comparison is simply the FD interest rate less inflation, telling us our ‘net return or gain/loss.’

How to prove a point?

Let’s take two different scenarios below and see where one as an individual who is investing money, benefits the most. The surprise here is, you count the benefit not in money, but in terms of the number of dosas you can buy. After all, an economy is about the purchase and sale of goods and services.

| FACTORS | MARKET TYPE 1 | MARKET TYPE 2 | |

| (HIGH INFLATION, HIGH FD RATES) | (LOW INFLATION, LOW FD RATES) | ||

| INVESTMENT AMOUNT | A | 10000 | 10000 |

| PRICE OF A DOSA | B | 50 | 50 |

| INFLATION | C | 10% | 6% |

| INTEREST RATE | D | 10% | 8% |

| NET RETURN | (D-C) | 0 | 2% |

AFTER ONE YEAR OF ABOVE INVESTMENT:

| FACTS | MARKET TYPE 1 | MARKET TYPE 2 | |

| (HIGH INFLATION, HIGH FD RATES) | (LOW INFLATION, LOW FD RATES) | ||

| INTEREST INCOME | E = A*D | 1000 | 800 |

| PRICE OF EACH DOSA | F = B*(1+C) | 55 | 53 |

| DOSA PURCHASE (w.r.t to Interest income) | G = E/F | 18.18 | 15.09 |

| DOSA PURCHASE (w.r.t to principal sum) | H = A/F | 181.82 | 188.68 |

| Total Dosas purchased | = (G+H) | 200 | 203.77 |

As you can see, you are benefitting from low inflation and a low-interest-rate economy. You are purchasing more Dosas with the same amount of initial investment. People always assume that even if inflation is high, they are getting high returns on investments. However, what they need to look at is, how many dosas can you buy at the end of the day?

If your ‘real returns’ are positive, even if it is just by 1%, your boat is not going to sink. So, look at your risk always like it’s a balanced plate of dosa. A big salute to Mr. Rajan for explaining it so well and for giving a path to the common man to invest better.