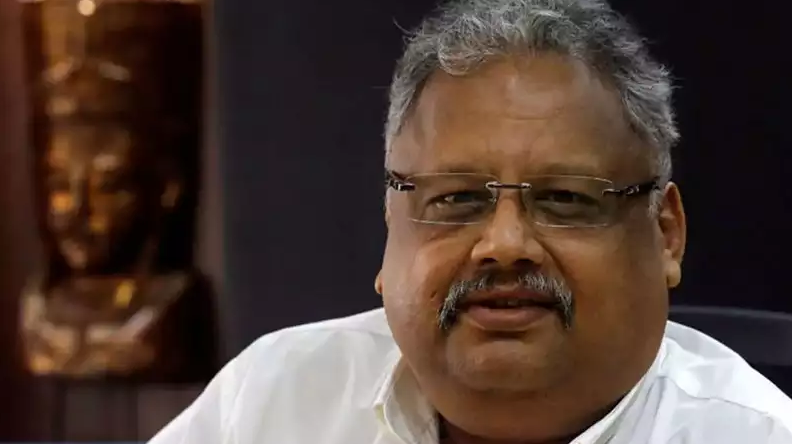

Rakesh Jhunjhunwala, an Indian billionaire investor & trader, bought a 0.5 percent stake in troubled private-sector lender YES Bank for Rs 86 crore on Monday.

Jhunjhunwala is known to invest in such lost projects and booking profits with them in the long run.

Jhunjhunwala bought YES Bank shares at an average price of Rs 67.10, valuing the transaction at Rs 86.89 crore, bulk deal data showed. His stake (0.5%) in YES Bank forms a minuscule portion of his portfolio which stands at approximately Rs 18,000 crore.

But what prompted the ace investor Rakesh Jhunhjhunwala to by shares of beaten-down Yes Bank?

According to buzz on Dalal Street, Jhunjhunwala bought the YES Bank share to offset his position in the Futures and Options market. However, this could not be verified.

Another reason could be that Jhunjhunwala sees potential in the performance of the private lender and is convinced about the bank’s improving financial position.

The bank has lately seen some recovery in its share price after informing exchanges that it had a binding offer from a global investor for an investment of $1.2 billion.

An infusion of capital would come as a much-needed relief for the bank, with its capital adequacy ratio barely above the regulatory requirements, as of June disclosures.

As reported by Business Standard, the YES Bank share prices have risen over 44 percent in a one-month period, with talks of a fresh investment improving investor sentiment on the counter.

On Monday, the bank’s managing director & chief executive officer Ravneet Gill said in a TV interaction that the overall bids received by the bank were to the tune of $3 billion. On Monday, the company’s share price closed 0.7 percent lower at Rs 66.

However, it will be determined with time if Jhunjhunwala’s investment clubbed along with the global investment actually turns out to be helpful for the banking enterprise or not.