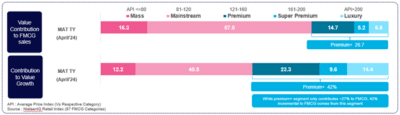

The report indicates that premium brands in FMCG are consistently growing approximately twice as fast as their non-premium counterparts. Similar trends are observed in the tech and durables sector, driven by increasing income levels, urbanisation, smartphone penetration, and a more aspirational consumer base.

Notably, smaller manufacturers or emerging brands in this space are registering faster growth in premium and luxury products compared to larger industry players.

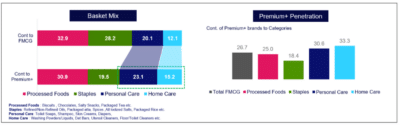

The report reveals that nearly half of all sales on digital platforms come from premium brands. Modern trade is also thriving, growing at twice the rate of traditional channels, with metro cities contributing significantly, while Tier 1 and 2 cities emerge as the fastest-growing markets, reflecting rising aspirations and greater availability of premium brands.

The south zone, organised retail channels, and metro cities are leading the charge in premiumisation, though growth is accelerating across all regions.

Tech and consumer durables industries are also mirroring these shifts. Products with premium features are seeing a 50% growth, with consumers increasingly seeking out items that promise convenience and improved lifestyle quality.

According to the NIQ Consumer Life Study, 41% of urban Indian consumers are now willing to pay more for tech products that simplify their lives.

The report also notes that the growth in premium FMCG is more organic than price-driven, with consumption volumes rising at almost twice the pace of price increases. Home care and processed foods have seen particularly strong growth, with consumers gravitating towards premium brands in these categories.

This volume-led growth reflects a shift towards higher-quality products, especially in segments like personal care and home care, where wellness and health-focused products are gaining traction. The south zone has the highest proportion of premium brand sales, while west and east are growing the fastest.

According to the NIQ Mid-Year Consumer Outlook Report, more than 70% urban Indian consumers are willing to pay a premium for a product that will last longer before it needs to be replaced. Indian consumers prioritise spending more on at-home experiences to save on outdoor dining and entertainment expenses.

The luxury segment within FMCG stands out as the fastest-growing category, with brands priced over two times the category average achieving remarkable success. Despite overall FMCG in India facing challenges to achieve double-digit growth, the premium segment consistently grows at double-digit rates across all markets and categories, driving half of the incremental sales for the Indian FMCG industry. The trend is visible particularly in the south and west zones.

Modern trade has become a critical launchpad for luxury products, particularly for smaller and medium-sized manufacturers who are outpacing larger players in this space. Meanwhile, in traditional trade, FMCG giants continue to dominate in terms of overall market penetration, though medium-sized players maintain a stronger foothold in the luxury segment.

Furthermore, modern trade is playing a key role in introducing premium and luxury products to the Indian consumer. Of all new product launches in modern trade, 58% are from premium+ segment. This is significantly higher compared to traditional trade, where premium launches account for 38% of new products. As a result, medium and small manufacturers in modern trade are experiencing faster growth than larger, more established companies.

Indian consumers are increasingly prioritising health and wellness in their purchasing decisions, particularly in the home and personal care sectors. The demand for superior-quality, natural, and chemical-free products with active ingredients as well as with proven benefits is driving premiumisation in these categories. Similarly, healthy options are steering premiumisation in food products.

The report clarified that India’s growing economy, characterised by a large working-age population, rising per capita income, and increased smartphone penetration and urbanisation, emphasises the need for manufacturers to focus on premiumisation as a key growth driver in the FMCG sector.

Speaking about the same, Roosevelt Dsouza, Commercial Head- India, NIQ, said, “We are observing an increasing convergence of aspirational consumer preferences with higher disposable incomes, as well as the presence and access to premium products. This shift is driven by digital platforms, contributing to nearly half of the sales. Market mix, channel diversity, and new entrants will further drive the adoption of premiumization in the future.”