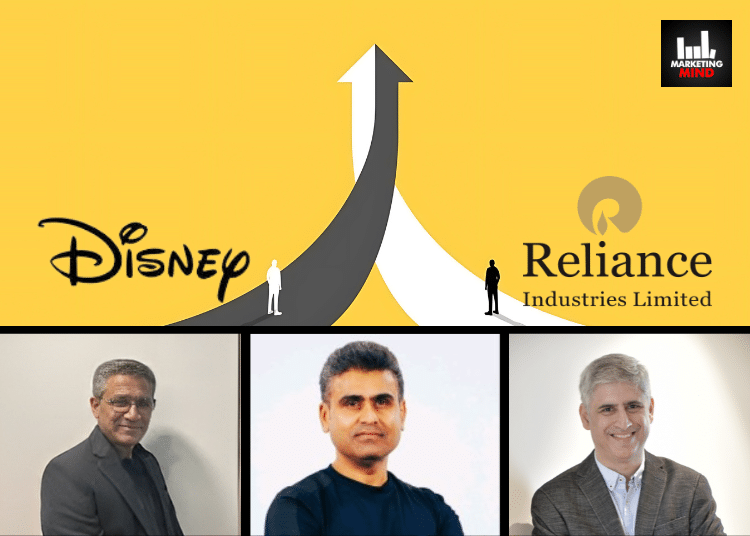

Since the beginning of times, it is a universally known fact that ‘1+1 makes 2’ but in some cases, like Reliance Industries, Viacom18 Media and The Walt Disney Company announcing the signing of binding definitive agreements to form a joint venture that will combine the businesses of Viacom18 and Star India, it almost feels as if ‘1+1 will make 11’.

Having gone through post the fallout of one of India’s most awaited mergers in the media landscape (Zee-Sony merger), the Reliance-Disney Merger has not only got the nod from Competition Commission of India (CCI) but also NCLT and hence is poised to make a big lollapalooza in the advertising galores.

With the merger getting all clearances, despite some hiccups, it is evident that the new entity which will be formed out of the merger between RIL’s Viacom18 and Star India and will be controlled by Reliance Industries Limited, who along with its subsidiary will own 63.16% stake in the company is something that everybody is eagerly looking forward to across industries.

Taking this opportunity to understand and comprehend what the headline makers of multiple advertising agencies in India- ranging from dentsu to Madison Media and Cheil India, Marketing Mind has learnt that while the merger will lead to the formation of a mega monolith and therefore lead to monopolistic outcomes, the advertisers will still have a level playing ground across mediums and if not sports, there’ll still be other media touchpoints in the multi fragmented ecosystem of ad mediums.

But given the importance of impact sports properties like the Indian Premier League itself followed by BCCI’s domestic tournaments, while marketers may be worried about ad rate hikes, or consumers will be at a bit of a ease in terms of subscription rates, the road ahead is still untraveled and is likely to come with its own ups and downs.

Sharing his perspective on the development, Harsha Razdan, CEO- South Asia, dentsu, mentioned that the Competition Commission of India approval to the Reliance-Disney merger is a ‘game-changer’ for India’s media industry.

“We’re witnessing the creation of the largest media conglomerate in the country, with a staggering valuation of $8.5 billion. This merger is set to command around 40-45% of the TV market and 30-35% of the digital space—a scale that’s unprecedented,” he said.

From an advertiser’s perspective, he specifically called this development ‘not just a consolidation’, but a rather ‘strategic realignment’ of the industry’s landscape, as with Reliance’s distribution prowess and Disney’s rich content portfolio, what is likely to germinate is a more streamlined operation and possibly even reduced subscription costs for consumers due to improved efficiencies.

“Advertisers now have a one-stop shop for everything from Hindi and regional entertainment to sports, music, and international content,” he suggested.

Keeping aside the magnanimity of the deal and the positive impact it could bring in the advertising landscape of India, Razdan, who had come into dentsu and changed the agency’s positioning to a Marketing+Consulting firm, himself, analyzed the gravity of the merger and implied, “With this scale comes the inevitable power to influence market dynamics, including pricing. The control over 80% of India’s cricket broadcasting alone speaks volumes.”

“While some may worry about rising ad rates, this is an opportunity for smarter, more targeted ad spends and a unique chance to integrate marketing plans across TV and digital platforms for greater impact and efficiency. The sheer reach and diversity of this new entity mean that advertisers can now connect with audiences on an even larger scale, across multiple platforms,” he said.

Furthermore, he also emphasised that the Indian A&M industry must adapt by focusing on creativity and consumer-centric strategies to navigate these changes.

“As this giant takes form, let’s ensure that we leverage its strengths to continue delivering value-driven, impactful solutions. After all, in the world of advertising, the only constant is change, and this merger is simply the opportunity to ride the next big wave,” he opined.

Being a popular name in the advertising media and investment lanes himself, Kumar Awanish, Chief Growth Officer, Cheil India, also shared the viewpoint that while this unprecedented and unparalleled merger coming around festival time is a ‘Diwali for all’, it will have a ‘dent in the pocket’ but ‘enjoyment at the end’ and will have its own share of challenges and highlights.

“Please note that oligopoly market structure is the best for both consumers and advertisers. It offers choices and brings efficiency. The moment it reduces to duopoly, it further limits those choices. And, here we are almost witnessing the ‘Monopoly’ – ‘The two coming together means there is limited or no competition at all’,” he implied.

Consequently, he mentioned that while the newly formed entity out of the merger of the two media giants- RIL and Disney does provide a one-stop shop for advertisers with a massive and integrated reach, which can then have better frequency control, if the advertising rate increases, then there is no choice.

“That said, I do believe that this phenomenon will largely have an impact on the sports genre and some exclusive live events. However, we are yet to see the full details of these voluntary modifications, which have been sought by CCI with their conditional approval. Other than that, advertisers will still have a choice in other genres. So bottom line, it might not impact everything and everybody, but yes, for some it might be cruel,” he mentioned as a cautionary warning.

On a rather hopeful note for consumers, he mentioned that there’s a high probability that the subscription might go cheaper as lots of operational costs tend to get reduced in such deals.

According to Vinay Hegde, CEO- Investments, Madison Media, the RIL Disney merger ‘definitely’ may have both ‘favorable’ and ‘adverse’ impact on the ad industry.

And while there have been multiple conversations around the favourable impacts of the merger, elaborating on what ‘adverse’ means in this context, Madison’s Hegde explained that because the newly merged entity out of the two media majors will create a ‘mega monolith’ and a ‘monopolistic scenario’ which reduces bargaining power and yet will have the potential of bringing in huge economies of scale as well.

“It will be interesting to see how the Sports genre develops considering that the merged entity will have a dominant share of live sports with IPL, World Cup, BCCI domestic etc. rights between these 2 entities. This also creates a media powerhouse with a huge content offering, a much larger digital offering and even movies,” he further mentioned.