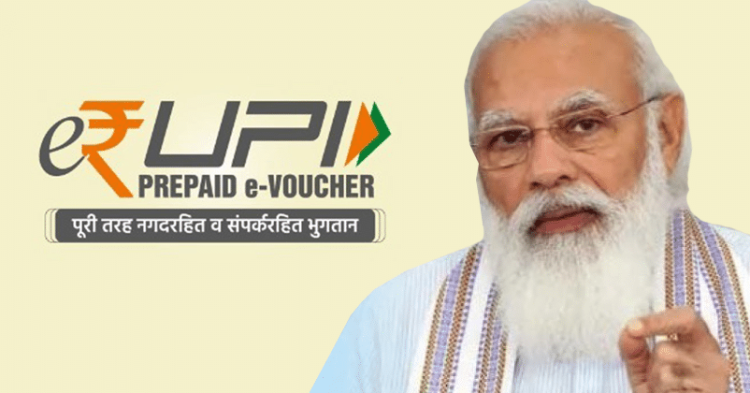

With the digital coin market bringing about a boom in the investment sector, Prime Minister Narendra Modi has launched an electronic voucher-based digital payment system which is called as “e-RUPI”. This platform has been built by the National Payments Corporation of India (NPCI), Department of Financial Services, Ministry of Health and Family Welfare and the National Health Authority.

How will e-RUPI work?

A cashless and contactless digital payments medium, e-RUPI will be delivered to individuals in an SMS string or a QR code to its beneficiaries. It will resemble a prepaid gift voucher which will be redeemable at accepting centres without any other payment method being of any need.

How are the vouchers going to be issued?

Built on the UPI platform, the NPCI has onboarded banks that will operate as the issuing entities. For whoever is interested in making transactions via e-RUPI, will have to approach any of these private or public sector lenders. They will be identified on the basis of the mobile number linked and the voucher allocated by a bank to the service provider in the name of a given person to whom it will directly be delivered.

How is e-RUPI different from other digital currencies?

With the government already working on developing a central bank digital currency, it serves its purpose in enabling the growth in the sector as well as aims to cover any gaps when it comes to transacting in the digital currency field. Moreover, e-RUPI is backed by the existing Indian rupee as the underlying asset. As a result, the specificity of its purpose makes it more of a voucher-based payment system as opposed to a virtual currency.

How does a central bank digital currency come into play?

The establishment of a central bank digital currency will essentially dictate a digital format of our nation’s existing fiat currency, the rupee. This will also lead to provisions for digital currency as currently, flat currency definitely gains more importance by a large margin.

Digital currencies are bound to go big in a country like India. Today, every second individual is making use of online platforms to carry out the smallest of transactions. Moreover, the spread of virtual currencies that have caused a boom in the digital coin market such as Ethereum and Bitcoin has definitely set an impetus for the future. The sustained interest in cash for carrying out smaller transactions online is being seen and it’s only going to be some time that everyone soon ventures out in the digital coin market.