In the age of digital convenience, managing your finances has never been easier. With the rise of smartphones and the increasing need for effective financial management, there’s a plethora of money-saving apps and tools at your disposal. These apps and tools can help you budget, save, invest, and keep track of your expenses with just a few taps on your screen. We’ve curated a list of seven top-notch money-saving apps and tools that can significantly improve your financial well-being. Say goodbye to budgeting woes and hello to a brighter financial future.

With the power of these financial apps and tools in your pocket, you can navigate through the complexities of personal finance with ease. From budgeting to investing, from shopping smart to monitoring your credit score, these digital solutions have the potential to transform your financial landscape. Embrace the era of financial technology and let these remarkable tools be your companions on your journey to financial success.

7 Money-Saving Apps and Tools:

-

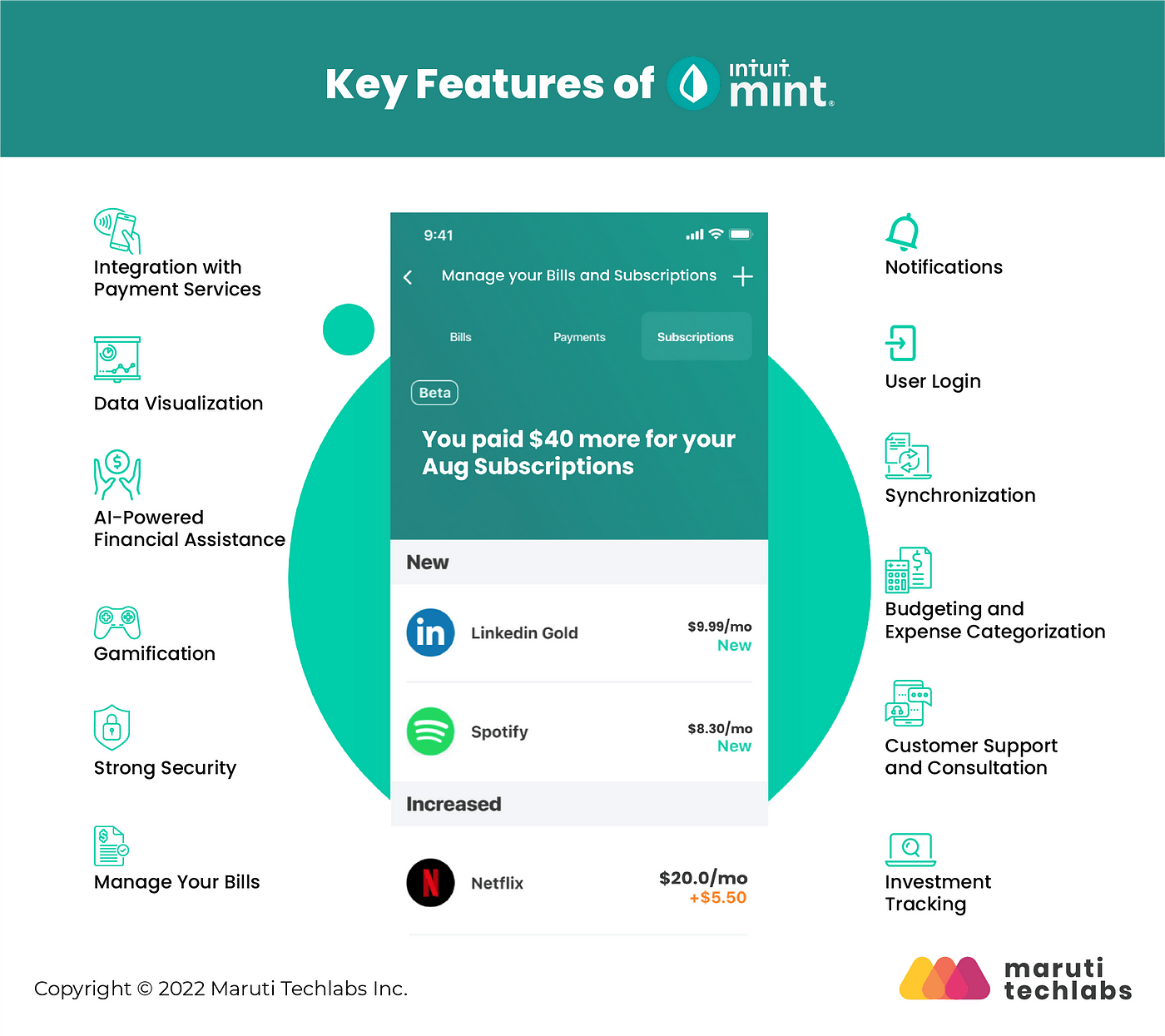

Mint: The Ultimate Budgeting Companion

Mint is your all-in-one personal finance app. It syncs with your bank accounts, credit cards, and even your bills to give you a comprehensive view of your financial life. It categorizes your spending, tracks your expenses, and creates a budget tailored to your lifestyle. With Mint, you’ll have a clear picture of where your money is going and how to save more of it.

-

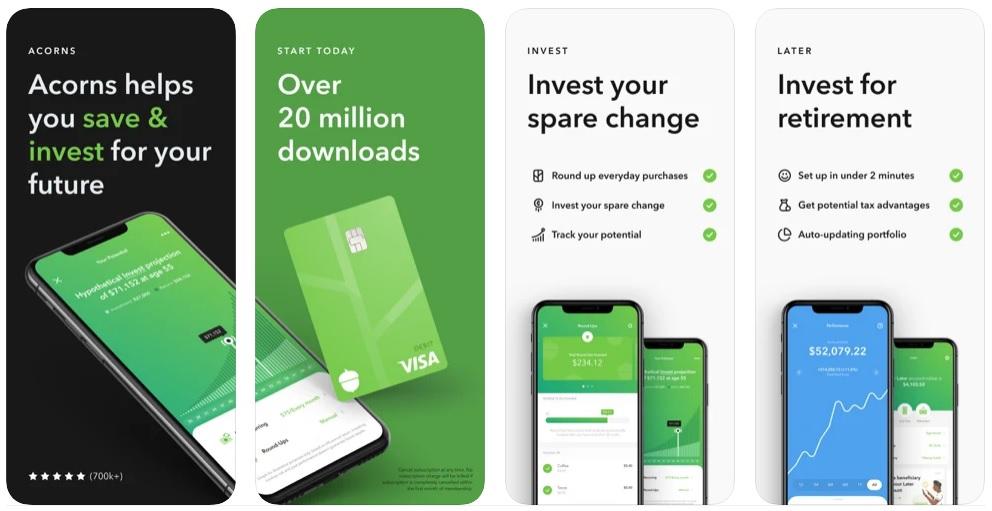

Acorns: Invest Your Spare Change Wisely

Acorns is the perfect app for those looking to dip their toes into investing. It rounds up your everyday purchases to the nearest dollar and invests the spare change in diversified portfolios. Whether you’re saving for retirement, a vacation, or a rainy day, Acorns helps you grow your wealth gradually.

-

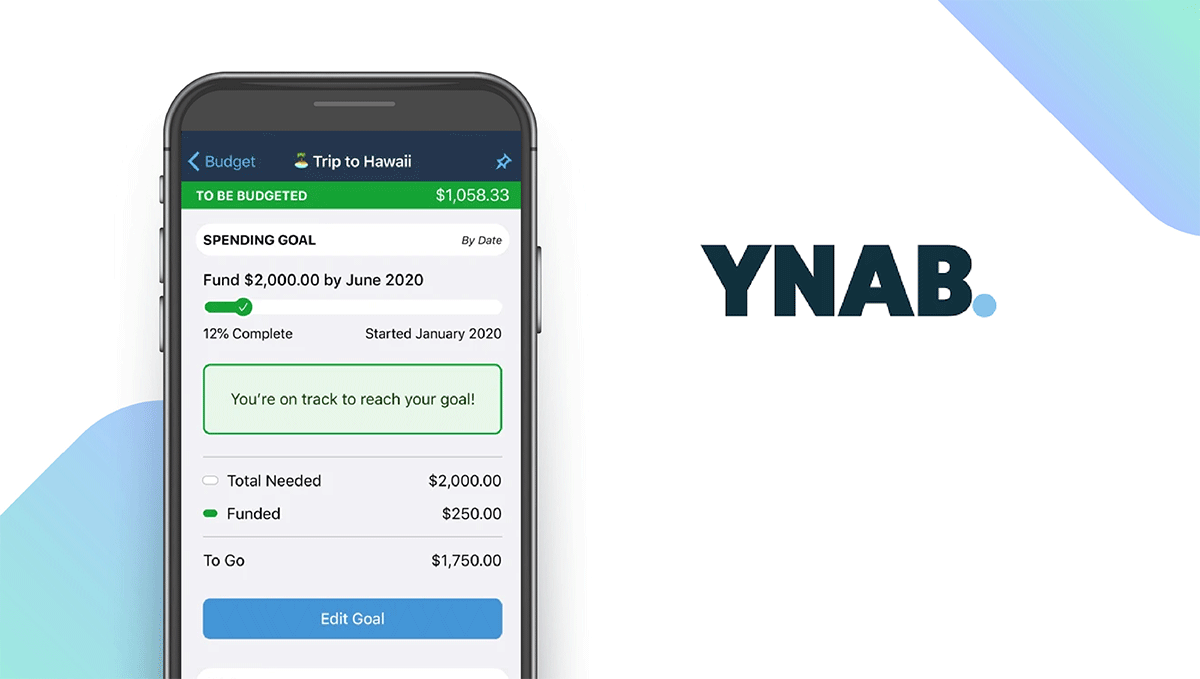

YNAB (You Need a Budget): Rule Your Money

YNAB takes budgeting to the next level. It operates on the principle of giving every dollar a job. You’ll allocate your income to specific categories, helping you control your spending and prioritize your financial goals. YNAB’s mantra is to “give every dollar a job,” and it excels at doing just that.

-

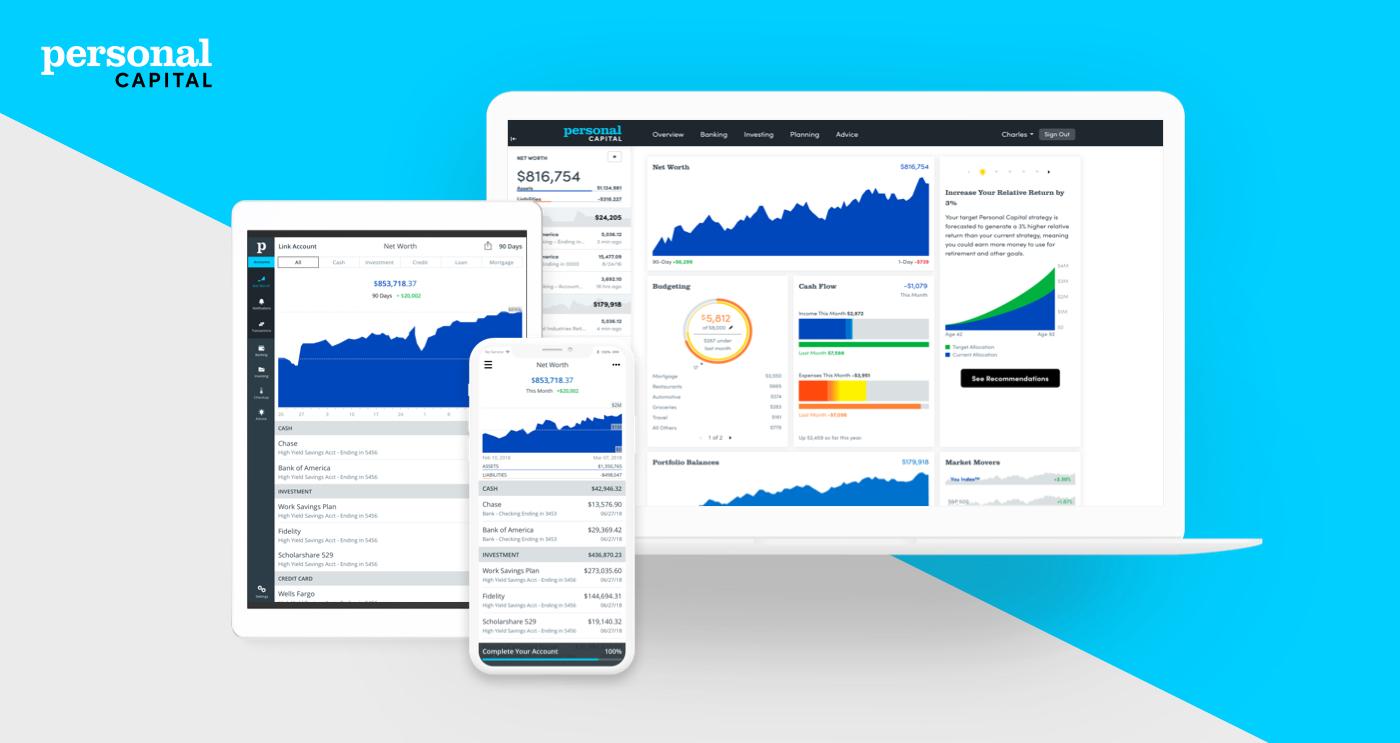

Personal Capital: Wealth Management Simplified

Personal Capital is an excellent choice for those focused on growing their wealth. It provides a holistic view of your financial health by tracking your investments, retirement accounts, and even your net worth. With its robust tools, you can plan for your future and monitor your financial progress.

-

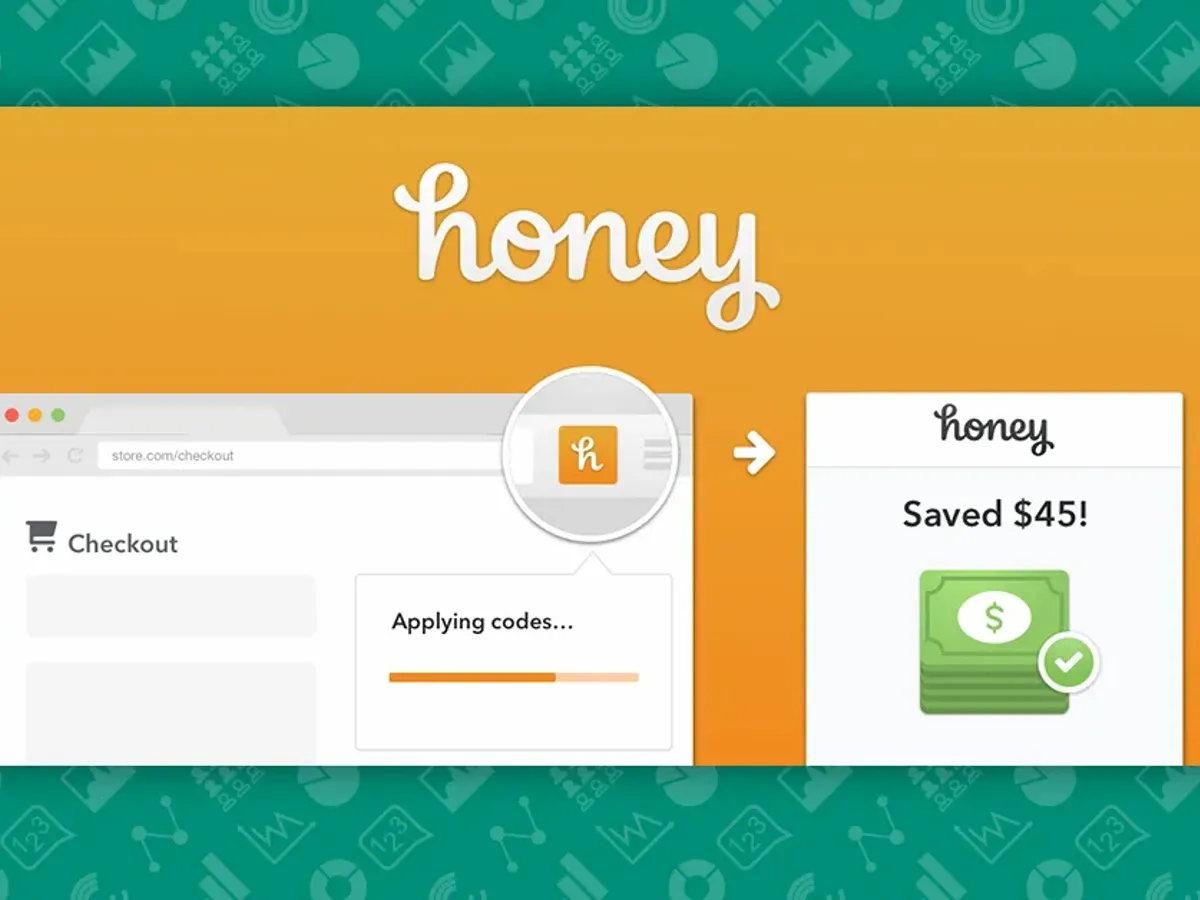

Honey: Shop Smart and Save More

Honey is a browser extension that finds the best deals, discounts, and coupon codes while you shop online. With just one click, Honey scours the internet for the best prices on the items you want to buy. This tool ensures you never overpay for your online purchases again.

-

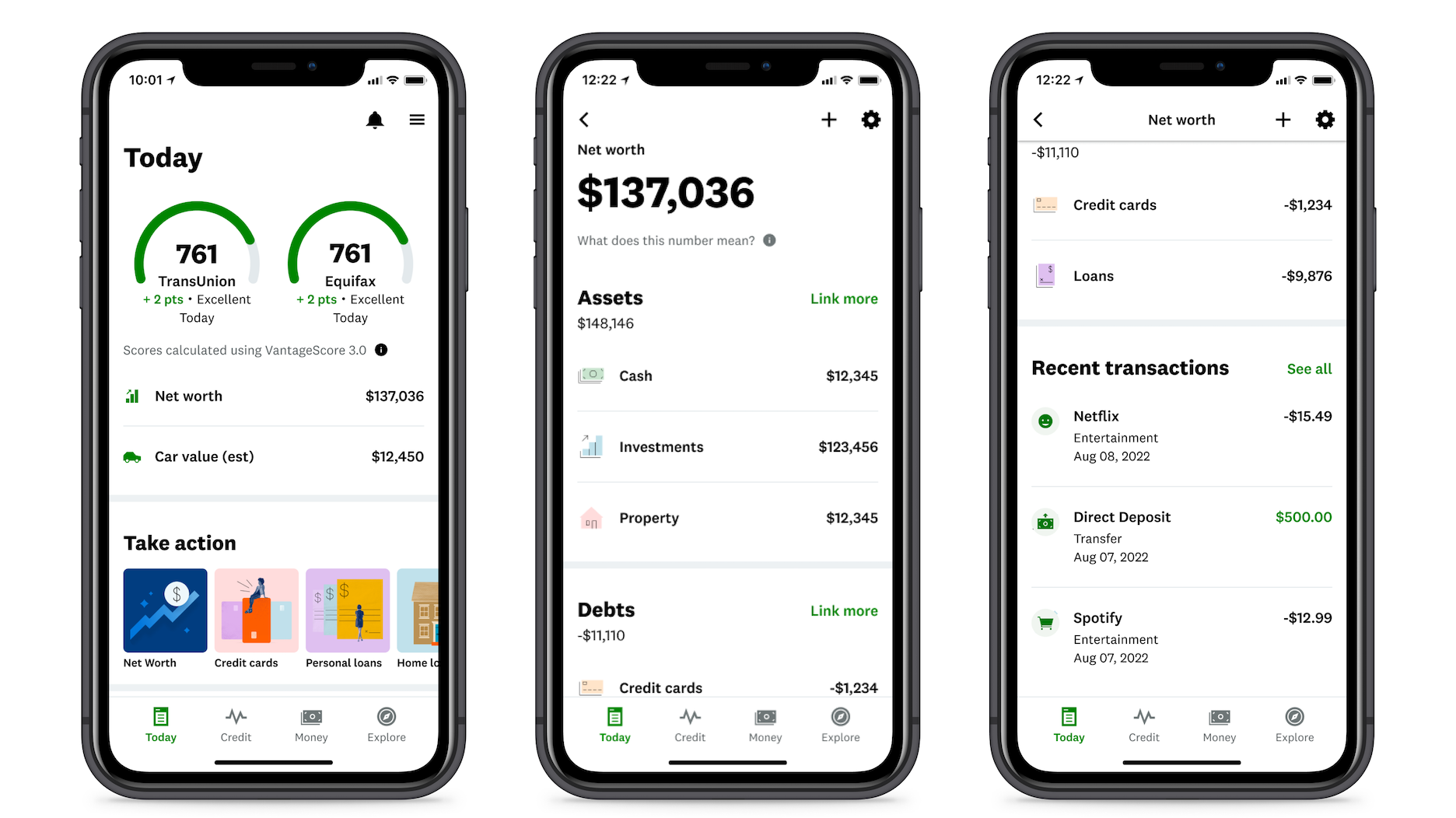

Credit Karma: Your Credit Score Ally

Credit Karma helps you keep an eye on your credit score and report for free. Not only can you access your credit scores from two major credit bureaus, but the app also offers personalized recommendations to improve your credit health.

-

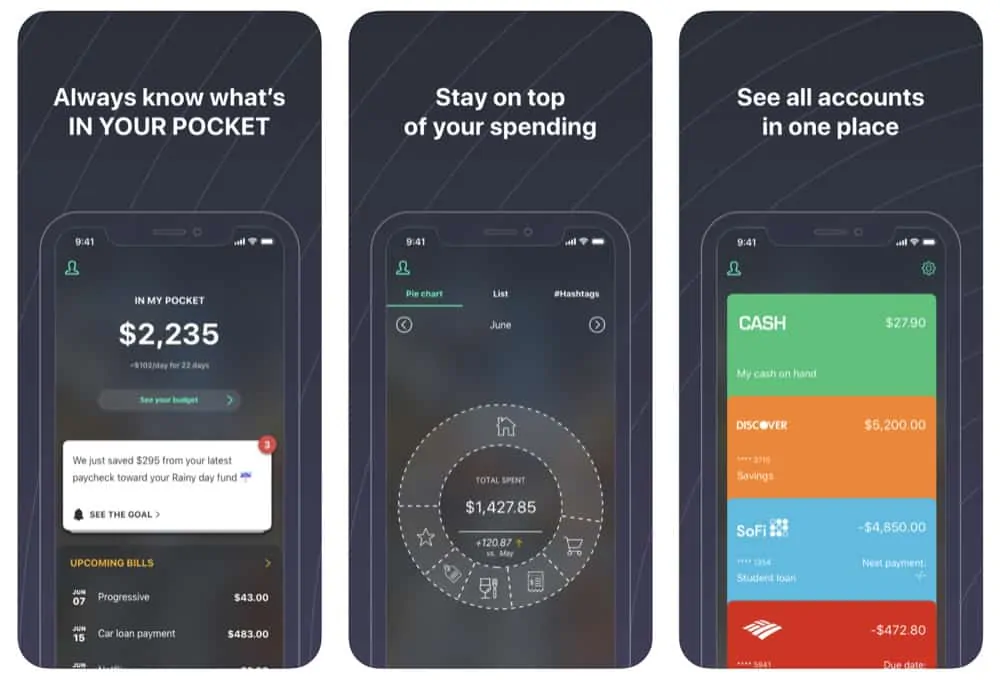

PocketGuard: Your Everyday Financial Tracker

PocketGuard takes a simplified approach to budgeting. It analyzes your financial data, tracks your income, and monitors your expenses. By focusing on the money you have left to spend, PocketGuard empowers you to make informed financial decisions.

Conclusion:

In the digital age, you don’t have to be a financial guru to manage your money effectively. These seven money-saving apps and tools offer a range of services to cater to your specific financial goals. From budgeting and investing to shopping smart and credit score monitoring, these apps have you covered. Embrace the convenience of modern technology and take control of your financial future today. Your path to financial success is just a download away.

In a world where time is precious and convenience is key, these money-saving apps and tools offer a glimpse into a brighter financial future, one where you have more control, better financial habits, and greater peace of mind. Embrace the power of technology to enhance your financial well-being and make your money work for you. Start your journey today and embark on a path to financial freedom and security.

Also Read – 05 Best Business & Finance Movies That Are A Must Watch